More About Pkf Advisory Llc

Table of ContentsAn Unbiased View of Pkf Advisory LlcAll About Pkf Advisory LlcPkf Advisory Llc Fundamentals ExplainedPkf Advisory Llc Things To Know Before You Get ThisA Biased View of Pkf Advisory Llc

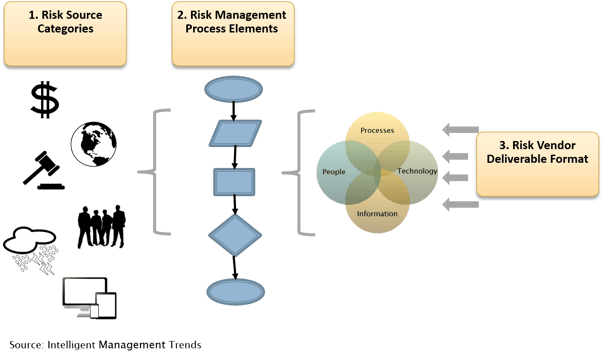

Centri Consulting Threat is an inevitable part of operating, but it can be handled with comprehensive analysis and management. In truth, most of inner and outside risks companies encounter can be addressed and alleviated with risk advisory ideal practices. But it can be hard to determine your danger exposure and make use of that info to position on your own for success.This blog is created to assist you make the appropriate choice by addressing the concern "why is risk advisory essential for services?" We'll also examine internal controls and explore their interconnected partnership with business threat administration. Put simply, organization dangers are avoidable interior (calculated) or exterior dangers that impact whether you attain your organizational purposes.

Every service needs to have a strong danger administration strategy that details present threat degrees and exactly how to reduce worst-case situations. One of the most crucial threat advising best techniques is striking an equilibrium between protecting your company while also assisting in continuous development. This calls for carrying out international techniques and administration, like Committee of Funding Organizations of the Treadway Compensation (COSO) internal controls and business threat administration.

Examine This Report about Pkf Advisory Llc

Among the ideal means to handle threat in service is through measurable analysis, which uses simulations or stats to assign risks details mathematical values. These thought worths are fed into a threat version, which creates a variety of results. The results are examined by threat supervisors, that utilize the data to identify organization chances and alleviate adverse end results.

These reports likewise consist of an analysis of the influence of unfavorable end results and reduction strategies if unfavorable occasions do occur - pre-acquisition risk assessment. Qualitative danger tools include cause and effect representations, SWOT analyses, and choice matrices.

With the 3LOD version, your board of supervisors is liable for risk oversight, while senior administration develops a business-wide threat culture. Accountable for owning and mitigating threats, operational supervisors supervise day-to-day company negotiations.

Pkf Advisory Llc Can Be Fun For Everyone

These tasks are normally taken care of by financial controllership, quality assurance teams, and compliance, who may additionally have responsibilities within the very first line of defense. Inner auditors offer unbiased assurance to the first two lines of protection to make sure that risks are managed suitably while still satisfying operational goals. Third-line workers need to have a straight relationship with the board of supervisors, while still preserving a link with monitoring in financial and/or legal abilities.

A thorough set of internal controls need to consist of items like reconciliation, documents, security, authorization, and splitting up of obligations. As the variety of ethics-focused financiers remains to raise, numerous businesses are adding environmental, social, and governance (ESG) requirements to their inner controls. Capitalists make use of these to establish whether a company's values straighten with their very own.

Social requirements examine how a company handles its partnerships with employees, consumers, and the bigger community. They also enhance performance and enhance conformity while improving operations and helping avoid fraudulence.

4 Easy Facts About Pkf Advisory Llc Explained

Constructing a thorough collection of inner controls involves approach positioning, standardizing policies and procedures, process paperwork, and establishing functions and duties. Your interior controls need to incorporate risk advisory best practices while always continuing to be concentrated on your core organization purposes. One of the most reliable interior controls are strategically set apart to avoid prospective problems and lower the danger of economic fraudulence.

Creating great interior controls involves implementing guidelines that are both preventative and investigative. They include: Restricting physical access to tools, stock, and money Separation of obligations Consent of billings Confirmation of expenses These backup treatments are created to spot adverse end results and dangers missed out on by the very first line of defense.

Internal audits entail a detailed analysis of a service's internal controls, including its bookkeeping techniques and corporate management. They're made to make sure regulative compliance, along with precise and prompt monetary coverage.

Pkf Advisory Llc Things To Know Before You Get This

According to this regulations, management groups are legally in charge of the precision of their business's economic here are the findings statements - restructuring and bankruptcy services. In addition to securing capitalists, SOX (and inner audit support) have substantially improved the reliability of public audit disclosures. These audits are performed by unbiased 3rd parties and are developed to review a firm's accountancy procedures and inner controls